f y m

f y m

To begin on a prosaic note, click these little charts to see them full size.

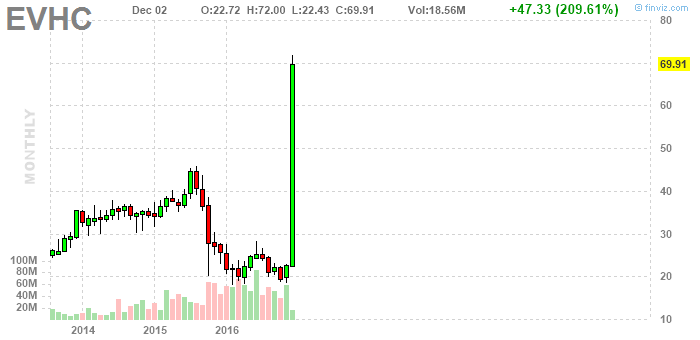

Wouldn't probably have predicted this giant gap, though it could be said there were clues. First and maybe foremost, on the monthly chart there was an alpine cliff, meaning it went up at a moderate rate (for two years), then dropped quite fast. Interestingly, the final leg of the decline formed a red bar with a big lower wick on both the monthly and weekly charts. Well, the bottom of that long wick proved to be significant as time passed, as we can see. With that said, while it would have worked out well to buy on even the first return to the bottom of that wick, I know I wouldn't have known, for one thing, that such a big move was in the offing, in time, or when that move was likely to occur. It true I might have suspected more sideways action was likely, but I don't think I would have had any strong sense of how much, or, as it could be described, how little, because it didn't stay under thirty for all that long a period of time, ultimately. Also, though I might have vaguely predicted the kind of fluttering up and down motion that did follow, say, the first return to the bottom of the wick (but I really mean followed the wick), I wouldn't have had any definite sense of what it's details would be like.

It does seem worth noting that this is a very large company - sales of more than 6 billion dollars - and it has made money every year for several years ... a guestimate of the p/e (based on earnings averaged over the availabele years) at the beginning of 2016 is, maybe, 50, a little expensive but not extremely so. (How do we weigh this? A slightly high price for a very large company is acceptable?) Debt would have been about twice current assets, which I'm starting to think is an acceptable ratio, and the current ratio would have been a very strong 3:1. As a fundamentals pick, then, it had its positives.

Now, of course, it would have been nice to buy this at the optimum price, perhaps with a stop in place, and then, beyond that, it would have been nice to buy it at the optimum time, though this assumes a dodgy notion that while this stock was biding its time between 20 and 30 we could have used our cash to achieve one or more gains in other places ... and still be in a position to buy this just when it was about to blast off. Well, let's pursue the line of reasoning even though I must insist it is not a very reasonable thing to do. I mean, I suppose we might see a situation similar to the chart as it would have appeared in November of 2015, after the wick, when we could have put it on a watch list, and then as it would have appeared that December, and in the early part of 2016, and then, if we something like that, I suppose we could hold off on buying, based, it is true, on a sample of 1, which definitely gives it a quality of the absurd ... though ... we do see these patterns over and over, at least in a fuzzy sense. Perhaps, even surely, I'm belaboring this to excess, but I do find it interesting that there were two sequences of red bars on the weekly chart, each followed by a solid green bar, in early 2016, so maybe those reinforce the idea that an important bottom had formed, once prices rose into the high 20s, and as they again returned to the low 20s later in the year. I also note, and maybe this is just for fun, on the daily chart, first, a sequence of red bars, followed by a green, in early April, and then a sequence of red bars followed by a tiny green bar just as prices approached the April low, at the end of October. OK, so, it's interesting, but what's the actual point. Well, one point - which, in a way, is a silly one, but it is a point - is that we could - if we were so silly - have contemplate attempting to buy with a close stop, seeing that combination in October. Now, the price did dip below the October low early in November, but it looks like it held up, just barely, above the April low. (One reason this is silly is the anxiety watching that would have caused us, if we had a stop in the market then.) Well, to continue with my speculative, almost mystical thinking on this, it's interesting to me, and I have to admit, extremely so, that the little rally that began November's action, and then the plunge back to the established low price, is a tiny mirror of the alpine cliff pattern I described at the outset. And if we look at this very microscopically, the tiny green bar that formed at the bottom of that cliff had a (proportionally) long lower wick.

I suppose, then, we could argue that, if we had seen all of this, in the evening of that day in early November, we could have gone in heavy at that point, with a stop just below the low of the wick on that little green bar, say.

Of course this supposes we would have anticipated some type of especially substantial move to follow. Now, it's true I have observed moves of this sort - of the sort that just yesterday occurred - to follow out of improbable looking patterns of at least vaguely this sort, and it's even true that the reason I'm especially interested in this particular pattern - beyond the fact that it did just do something quite outrageous, this stock - is my interest in the kinds of moves just described ... but I know my mind, and I probably would have been predicting, not a giant move all of a sudden, here, but maybe a succession of more modest moves. To this we can add an additional question: would I have predicted a move of any sort to the level now achieved ... which is to say, to a level well above the established high (of 45)? Well, you know, I might have, up to a point. I mean - and now I'm speaking in hindsight, even if I might have had some such thought without the benefit of that - maybe the alpine cliff pattern does predict something of the sort.

Three final thoughts. Two have to do with additional minutia, and with one notion, which is, what to make of something like this when prices have begun to move up off a bottom in the pattern. What if, say, seeing the early November buying pattern as described, we had predicted that it would pause for just a bit, as it did, under all those tops it made in September and October, and the one in early November. And then, when it did hesitate under those levels, what kind of pattern would we have been looking for to signal an entry with a close stop? Well, it did make two little bottoms in there, and then - and how I love this kind of thing - it made a tiny wedge of two green bars. And, the next day, a little red inverted hammer ... with, interestingly, huge volume ... would have been the pattern into which we would have had to buy, and could have bought ... with our stop just below those two little bottoms. To continue, now, with the other part of this discussion of the minutia, I note, in early June, an intriguing small green inverted hammer at the top of an upward slope. The way, in theory, to treat an inverted hammer is to buy on a return to the real body, with a stop just below the hammer low ... which at least would have turned out to be a fairly harmless venture.

The final thought, then, is this: now that we have enjoyed seeing this outrageous move to higher prices, is it time to sell? I have an opinion, which is that this ought to be the beginning of something, and that something ought to reward the investor - the one with a long term approach. With that said, we are unlikely to see more action possessed of this kind of velocity. Also, it's my understanding the company has been acquired, and that that is what precipitated this move. I have no idea whatsoever what this means for someone in possession of these shares.

Here are charts of the latest data, if you are reading this some time in the future.

OK, it looks like it's not a being acquired, it's a merger.

I was going to add that I know really nothing about the company. This is an admission. It's my understanding that masters of long term investing, notably Warren Buffett, seemingly know a great deal about the companies they buy. How they come by that knowledge is pretty baffling to me. I mean, Buffett is famous for reading the annual reports. I have read some annual reports, but I don't end up feeling that well informed. I can get a feeling from them, but I'm not sure that amounts to being informed. And those reports can be pretty tough going. I've read that Buffett also reads a lot of news, and I'm sure that helps him to be informed, but he's also a schmoozer ... which I simply am not. So, again, would this now be a hold? Was it really a buy? Based on some minimal information a case could be made for it, before it jumped, as I've described ... and then there's the possibility of buying with stops. I've described how that might have been done ... although I'm not sure if what I described is realistic. Think about that a little. What could I do now to find a stock like this. Here's what I'm thinking. When it made its key pattern, the mini alpine cliff, in November, it was down about 30% in a year. I suppose I could scan for stocks that are down, say, 20% in a year, and review a lot of them every day, looking for telling patterns, of which the ones described here are examples. Finding one such I could look at the stock in more detail - long term charts, fundamentals. It sounds hard, but, based on my experience, it might be doable.

Now I'm going to move on to some personal philosophy. I'm basically in a deep, life long loserish hole, and I'm just doggedly trying to dig myself out of it. I'm unemployed and unemployable. Though I live on a pretty minimalistic budget, and don't have much money for investing, fortunately I'm not homeless, and not completely penniless, so I have the luxury of doing this kind of thing to try to get somewhere. Also, I count myself lucky to not be freaking out too badly. I sort of keep my head down and do what I can, which has a long history of not producing results, but I think it sort of keeps me out of trouble, and maybe it'll eventually pay off.

I also have a bit of a rebel mindset. I think I'm in this hole I'm in because of my early indoctrination in a kind of poverty mindset, the idea that wealth and the pursuit of it are kind of evil that ought not to be engaged in. Really, it went beyond that. Making a living was in a certain way frowned upon. We were supposed to be engaged in more noble pursuits. It's not, I might add, really my intent here to criticize anyone. If I told the whole story, it would end up being one of praise, to a certain extent. Here, though, is the upshot: I ended up taking a distinct kind of delight, partly as a stick in the eye of prudery, partly as a kind of sensual thing, in the pursuit of wealth. I would also go so far as to say it's just good sense.

I will go further and say that I carry this to a certain extreme. I love to take an interest in anything that promises at least a somewhat legitimate chance at, to put it simply, making money - I might add, without taking employment, not that I'm arguing against the latter in any sense, but I will argue with anyone who says it's some kind of moral necessity ... even though in some sense it is. So, I take gleeful interest in all sorts of dodgy schemes I encounter. Now, I have been somewhat careful to avoid expending excessive funds on such promises, while, at the same time, I've allowed myself to expend some ... so far without overtly benefiting myself, by the way. I say not overtly because I may have learned a few things from these adventures and misadventures, which latter they have sometimes been, though, happily, none have been outright disasters.

Moreover, I am quite willfully maintaining my interest in these things. Now, I want to add that I am not an advocate of outright robbery. If I'm going to buy, say, a course, or entry into some sort of program, I want its face to be at least something a bit cheerful, and maybe in some way seeming high minded. Of course, these are rather vague assertion. I actually feel I've been robbed a bit along the way, but I don't really hold it against these people. As I say, they've been on the whole cheerful types, who I've allowed to rob me a bit, and they've even made what I can only describe as rather concerted efforts to help me, in a way. I mean, if I can only make such an effort, I'll feel justified, I think, in practicing what these people demonstrate, that is, the delivery of a lot of material, even if it in the end wasn't all that helpful. Too, they would, as a rule, say I didn't do the work, and didn't adequately commit, and I would have to agree, as a matter of fact. I also lacked the wit to do the work, and to make it work, so I think about that: how to achieve that level of cleverness.

I was inspired to undertake this essay by an approach of this type I encountered online the other day. All of a sudden, quite out of the blue, these couple of guys were talking to me live on Facebook, about their fabulous money making program. And boy were they enthusiastic, and boy were they cheerful and upbeat. I liked them a lot. I could feel the strong desire rising in me to join their completely free 100 day program. But the next step was to click something and sign up, and then there would I guess, be other things to do right away, and I was feeling a bit pressed for time and didn't act on that. So it goes. I did make a note of their links. I might get back to you with a sales pitch!

True, what they were selling sounded pretty scammy, at least in the hackneyed sense that they were selling, first up, or offering to teach me how to sell, information about how to sell information about how to sell information. Ha! I loved it! A self righteous friend had derisively described just schemes. What fools would fall for that, he asked, sneering, and what kind of despicable person would peddle such wares? I resolved right there, disgusted with him, to get into the business. I would even make an argument to justify it. And another know it all I encountered the other day - can't quite remember who it was - was saying that justification is making up a story, as in, fiction, to convince yourself you are doing something legit. Actually, that's rationalization, and justification is another thing ... but I wouldn't even knock rationalization. Someone who says rationalization is an evil is just rationalizing their own superior attitude.

As a matter of fact, these two high energy salesmen I'm talking about provided a pretty good justification for their practice themselves, and they did it without the slightest hesitation, which I thought was admirable. They argue that they are teaching people how to sell, and you can learn by doing by selling their product, as an affilliate, in their network marketing system, and then once you know how to sell, you can sell anything, which is an ability that can be of the greatest usefulness to all sorts of people.

Granted, I'm wary. For one thing, it's not my intent to be a scammer. That's partly an ethical position, but I don't give ethics as much credence as its peddlers would like me to. It is, however, also that I worry about getting into trouble. I'm not sure I could deal with it. But, you know, there's a place for risk. I think it could be said that life is about taking risks and getting away with them. If you can allow yourself to get singed a little, without getting burned, or burned too badly, maybe that's the way forward. (I was just reading about the reigning world champion arm wrestler. He prepares very doggedly, and thus, at least in part, his prowess, but at one point in a match his arm bone spiral fractured, making, he said, the sound of a two by four cracking in two. He reeled, and was taken to the hospital, and it was a very severe injury. But he said his tendons had become strong but his bones hadn't kept up. And, after he recovered, which took two years, he became world champion. Well, my thought was, that's one way to strengthen a bone!)

Anyway, I've become really interested in affilliate marketing. I've been interested in it for a while. I really like the idea. Now, my holier than thou friends would say that's just a scam, all by itself. But they would say that selling is a scam, period. Sure, if you pressed them, they would say that some kinds of selling are legit, but they wouldn't be able to defend their position, because it's nonsense. But, to continue, the extent to which I've made progress in the field of affilliate marketing is this: I managed to get myself approved as an Amazon Associate.

I'll tell that story a little bit. Now, I love the idea of being an Amazon Associate seller. They've got a great catalog! I buy from them quite a bit, as a matter of fact. I really appreciate the store. So, to help people find the wonderful products they'll really enjoy, or might really enjoy, seems like a nice dream, to me. Anyway, it sounds simple enough, joining their associate program. All you do is sign up, and right away you can get links. But it turns out that that initial sign up process gets you a three month probationary account - or maybe it's six months, or something. And, during those months of probation, I failed to sell one darned thing! And then I got a notice that I had to sell something pretty soon or my trial account would be cancelled. By the way, Amazon is a pretty decent company. They assured me I could sign up again, but they wanted me to get a result just to show I was actually interested, I guess. So, my time was running out, and I had to admit it remained unlikely I would sell anything, anytime soon. I had made a kind of effort, and I'd even gotten some people, I knew, to look at the pages I had posted, and even advertised, but no one had sprung for anything. Well, I really wanted to keep my account. So, Amazon Associates help is unusually responsive, I had found, since I'd inquired about a couple of thing. I sat myself down and wrote them a rather impassioned e-mail, saying how enthusiastic I was about the program, and how much I would appreciate if they would give me an extension. I very shortly received a reply, explaining that they simply could not give me an extension, but that, again, I should feel free to reapply. So, what was I to do. But, a short time later, I was notified that I'd been approved! My message, I guess, had been sent up a level. Oh, was I happy.

Nonetheless, I have still to sell anything.

And I think about it. I want to sell something!

Well, these guys I've been telling you about were saying all I have to do is get one person to click through to their funnel a day for 100 days, just one person a day. I mean, it sounds sort of easy, or sort of sounds easy, but then, I have been at this for a while, so it also sounds sort of hard, or sort of sounds hard.

Here's the key question: how do I get my links in front of people? I've been thinking about that all weekend.

Now, I tried running Facebook ads for a while. For a dollar a day, I could get my ad in front of a fair number of people, and a satisfying number even clicked through to my copy, but apparently my copy wasn't any good. Nobody bought anything ... and I discovered that my bounce rate was through the roof.

So, if my copy was no good, what was the point. Besides, even though I love Facebook ads, and quite often click them, and I totally admire the program, I found the ad buying process difficult to understand, even impossible to understand. Go figure. Plus, that dollar a day was adding up.

So, I long ago stopped my Facebook ad. Nor am I planning to start it up again, not until I resolve the surrounding issues. But, where does that leave me?

Well, I could put ads in front of my friends on Facebook. I don't have any moral objection to doing that. I'm proud of my ads. But I also don't want to be annoying about it, and I haven't quite figured out, in my mind, how to achieve that.

What about Twitter? That was the next thought that floated in front of my third eye. It's pretty cool that I can get people to read my tweets, if I want to. It's not that anyone follows me, to speak of, but I can message people, of course. I mean, pretty cool is an understatement. Although ... still ... I don't want to annoy people. I want to delight them, if I can. And that's something I have to think about more.

Well, there's also StockTwits. I've actually had a couple of wild little adventures over here, where I definitely got a little bit of attention. I very soon felt completely out of my depth, and stopped posting darned quick again. But, that doesn't mean it's not intriguing. Not, of course, that I can just post an ad. I guess I'd get hated pretty bad if I did that. But what if I could write something, and put and ad in there?

Hmmmm.

Well, it's Sunday, and I've been going at this pretty good all afternoon, but yesterday I got that idea - while hiking, and praying to the mountain spirits very fervently - and, back home later, I wrote another essay along the same lines as this one, and even popped an ad in it, and then I was writing about some of the resources I use for my research, and I was thinking how I wish I was an affiliate for those resources. One of them is Robin Hood, the commission free brokerage, where I'm trying to set up an account - struggling to, struggling with the process - and the other one is Finviz, which has really become my go to place for research. Say, I thought, don't they have an affiliate program? I guess I could take a quick look at the sign up procedure.

Over to Finviz, and sure enough, there's the affiliates link. I click through and ... Holy Crap! There's my affiliate link, ready to go!!!!!!!

Guess what, I'm just about done for today. But let me close with a few words about Finviz. I mean, you already know how great it is. Sure, it's maybe not the most professional tool, but then, you know how elegant it is, and you know how much they give you, which is such a lot, completely for free. And boy did I take advantage of that, and for a couple of years. But I finally decided to spring for a payed account, which makes me Elite, you know, lol. I mean, it wasn't like I absolutely needed it, or would necessarily get that much out of it, but I decided it was time to spring for something. I'd been doing everything so much on the cheap. So now I have lovely live charts ... that's the main benefit. Also, I'll throw in a brief word about about how much I appreciate the fact that I can publish their charts, and not just live ones, historical charts. That's, in my opinion, kind of huge. Here's my weird system: I use Blogger, which is so dreamy, and so completely free - free of charge, you see - to attempt, at least, to track my observations, to paper trade ... and even to track my positions. Well, now that I have an Elite account, I can publish intraday charts, which is really fun, and you can't do that with a free account.

And the Elite account comes with that affilliate link, ready to go! So, if you buy an Elite subscription, $140 a year, as I recall, and you stay with it for a year - or buy a year at a go - I get $30. Hey, if I can sell a thousand, that's decent money.

No comments:

Post a Comment