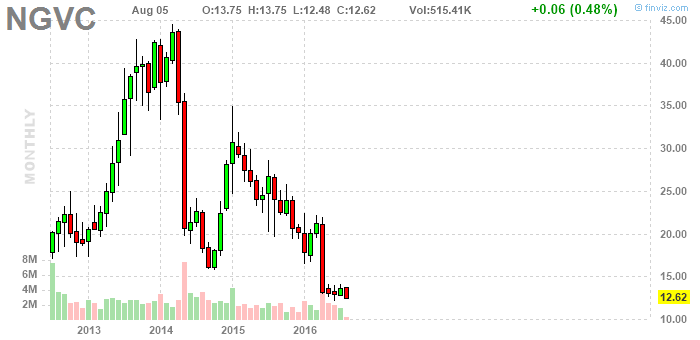

p/e 25 p/b 3 revnus $1.6 B up 3x in 4 yrs (earnings were up a lot in 2013 and 14 but fell back to near 2012 levels last year)

p/e is, say, 12, oh, yeah, and book is negative ... they seem to like it that way. assets, liabilities, revenues and earnings all grow like clockwork about 20% every year.

No comments:

Post a Comment